Knowing your credit score is important when it comes to making financial decisions that will require you to apply for credit. It is a good rule of thumb to know the requirements for getting approved before you apply.

Without knowing your credit score you are taking a stab in the dark when making these types of financial decisions.

Once upon a time, you could only get your credit score free from each reporting agency one time a year. Luckily now that are multiple ways to get your credit score for free.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

What is a Credit Score?

According to Credit Karma, a credit score is a three-digit number that indicates how likely you are to repay debt. Lenders use your credit score to determine if they will lend you money.

It is important to note that there is more than one way that your credit score is calculated. Each of the three main credit bureaus (Equifax, Experian and TransUnion) calculate your credit scores based on models that they have created.

This means that your credit scores for each credit bureau can be different. With all models your credit score is mainly determined by things like if you pay your bills on time and if your accounts are in good standing.

FICO Score

The FICO Score is a credit scoring method created by the Fair Isaac Corp. FICO scores take into account various factors in five areas to determine credit worthiness:

- payment history

- current level of indebtedness

- types of credit used

- length of credit history

- new credit accounts.

FICO Scores range from 300 to 850. Scores above 650 indicate a very good credit history. Conversely, scores below 620 are looked upon unfavorably.

VantageScore 3.0

The VantageScore 3.0 Model is a credit scoring method created by all three credit bureaus. They collaborated in an effort to provide more scoring consistency between the three agencies.

VantageScore 3.0 using the following “influence” factors to determine your credit score:

- Payment history

- Credit age and mix:

- Credit utilization

- Balances

- Recent credit applications

- Available credit

Although previously on a different scale, VantageScore 3.0 scores range from 300 to 850. Just as with FICO, a score of 850 is the best.

It is also important to note that your VantageScore 3.0 takes into consideration recurring payments such as utilities, rent, and phone bills.

Where to Get Your Credit Score Free

When applying for credit it is important to know which credit score will be used and which credit reporting agency the issuer will check.

If you have this information you can find out what your credit score is before applying to make sure you qualify.

Here are some places you can get your credit score for free, which includes the type of scoring method used and the credit reporting agency responsible for providing the score.

Related Post: Tools Best Tools and Resources to Manage your Finances

#1 Credit Karma

Credit Karma gives you the ability to see your TransUnion and Equifax VantageScore 3.0 credit scores. This is included in the services that they offer you with their free account.

Score Type: VantageScore 3.0

Reporting Agency: TransUnion and Equifax

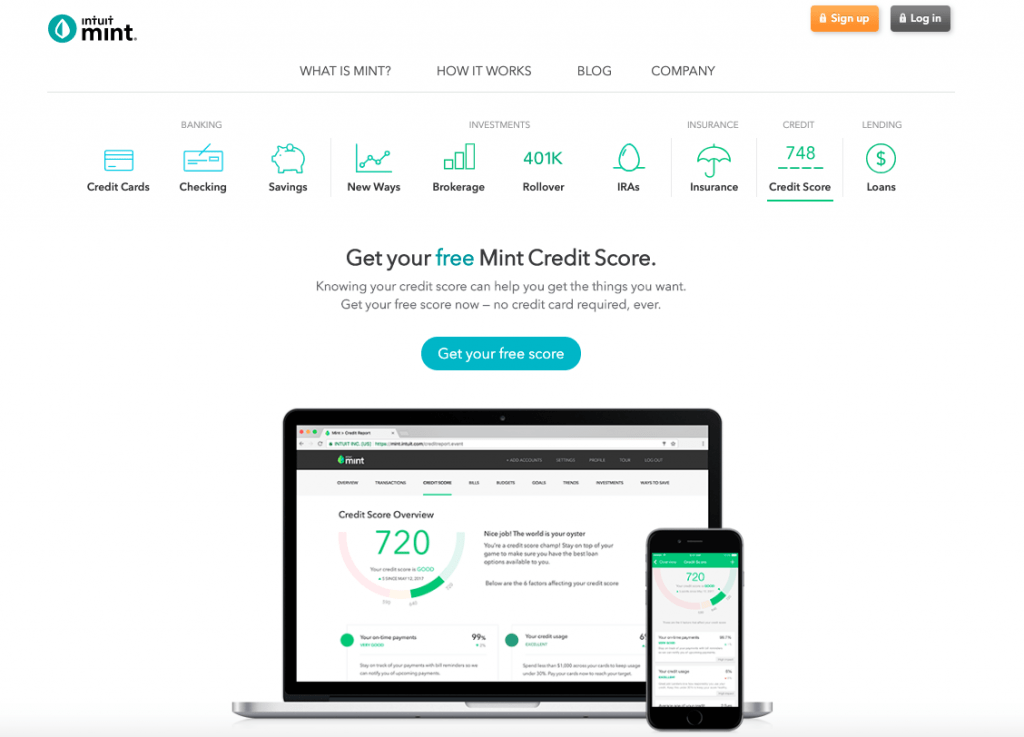

#2 Mint

Mint will give you access to your TransUnion VantageScore 3.0 credit score. Mint is also a free service.

Score Type: VantageScore 3.0

Reporting Agency: TransUnion

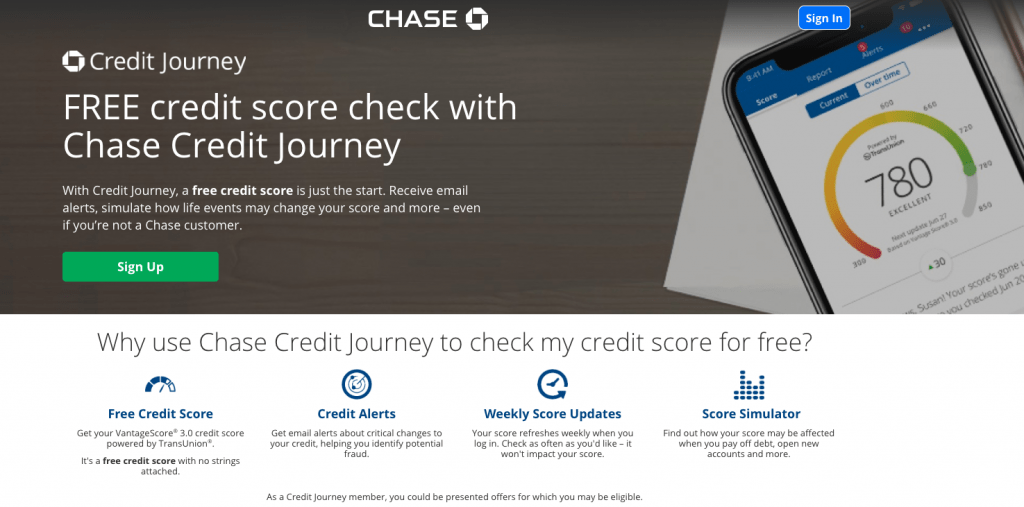

#3 Chase

Chase offers free weekly credit score checks with their Chase Credit Journey service. Their service allows you to see how life events will affect your credit. Chase Credit Journey can be used by anyone, even if you are not a chase customer.

Score Type: VantageScore 3.0

Reporting Agency: TransUnion

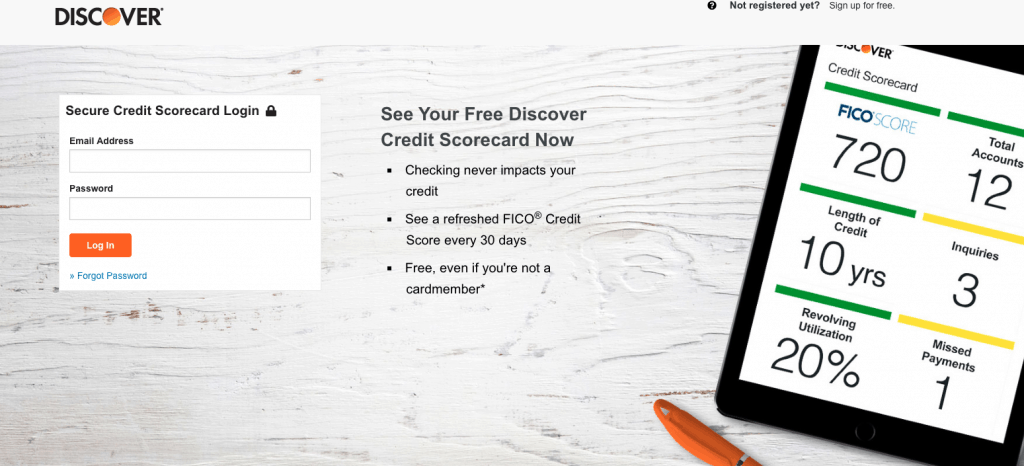

#4 Discover

Discover offers the public a free Credit Scorecard. This service is available to you even if you do not have a Discover credit card. With Credit Scorecard, you can get your FICO Credit score powered by Experian every 30 days.

Score Type: FICO Score 8

Reporting Agency: Experian

#5 American Express

American Express offers a My Credit Guide service where they will provide you your TransUnion VantageScore 3.0 for free each week. This service is free and you do not have to be an American Express cardholder.

Score Type: VantageScore 3.0

Reporting Agency: TransUnion

#6 Capital One

Capital One offers free weekly credit scores via their CreditWise service. Anyone can sign up for the service and monitor their credit for free.

Score Type: VantageScore 3.0

Reporting Agency: TransUnion

Leave a comment and share how you get your credit score for free.

Don’t forget to Like, Share, Tweet, and Pin this post.

Great reminder to keep a check on credit ratings, just to make sure no one has tried to use our identity too! Thank you for these resources.

Very true Jennifer. You should always have an eye on your credit.

Great post! Very good advice and useful as well! Credit scores are really important to monitor!

Thanks Stephanie!

…ummm I had no idea it was this easy! Thank you so much!!

You’re welcome Ashley. It is super easy to stay on top of your credit score.

Thanks for these great options. I’m not the greatest at keeping track of mine but should be more aware. Thanks for these options.

If you use Credit Karma they will alert you of any changes to your credit report. You don’t have to actively monitor it.

This is great to know! I’ll definitely look into Credit Karma I always see their ads.

Credit Karma is one of my favorites. I love their smartphone app and their alerts are very timely. No need to pay for a credit monitoring service if you use them.

So important to keep track of your credit score! Thanks for sharing!

Lauren | https://www.laurelandiron.com/

You’re so welcome!